Includes $101 p/w in running costs

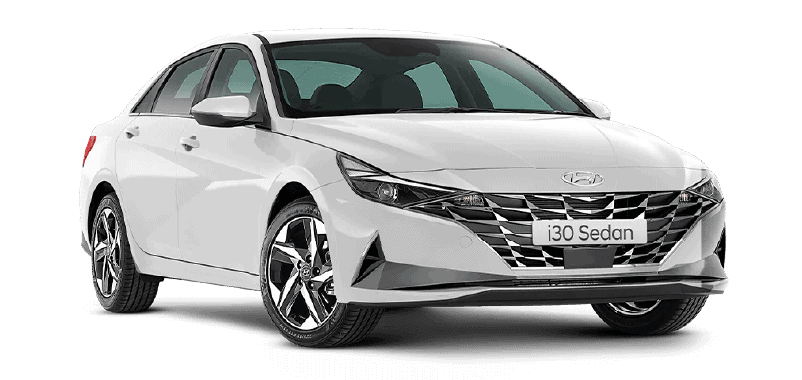

Hyundai I30 Active Sedan Automatic

Includes $101 p/w in running costs

Why a Novated Lease?

A Novated Lease is a tax effective form of financing your vehicle. It allows you to pay for the vehicle and all it’s associated running costs using pre & post tax money. This method reduces your taxable income resulting in savings of thousands

Pay Less Tax

Make repayments, maintenance, fuel / charging, insurance and even registration from your pre-tax income, and reduce the amount of tax you pay upfront.

GST Savings

As Novated Lease finance is treated as a business transaction, this means you don’t have to pay the GST on the purchase price of the vehicle. Saving you effectively 10% on the vehicle price straight up! You also save the GST on your running costs

Leasing options

A range of novated car lease options allows you to choose those with flexible terms, fixed interest rates, and no deposit requirement.

Flexible Vehicle Choice

You can package any vehicle (new, used and even existing) We can even offer a refinance option to potentially re-gain some of the benefit you have missed out on over your remaining finance term.

End of Term Profit

If you wish to sell or trade-in your vehicle at the end of the term, any profit above the residual value is yours to keep TAX-FREE

Employer Options

You can choose the car you want and take it with you to your next job if you change employers.

Testimonials

Testimonials